The Cashback Loan helps you build savings while you repay a loan

It’s part of our Foundation’s goal to help our members grow financial resilience, and it’s one of our most valued and favourite products.

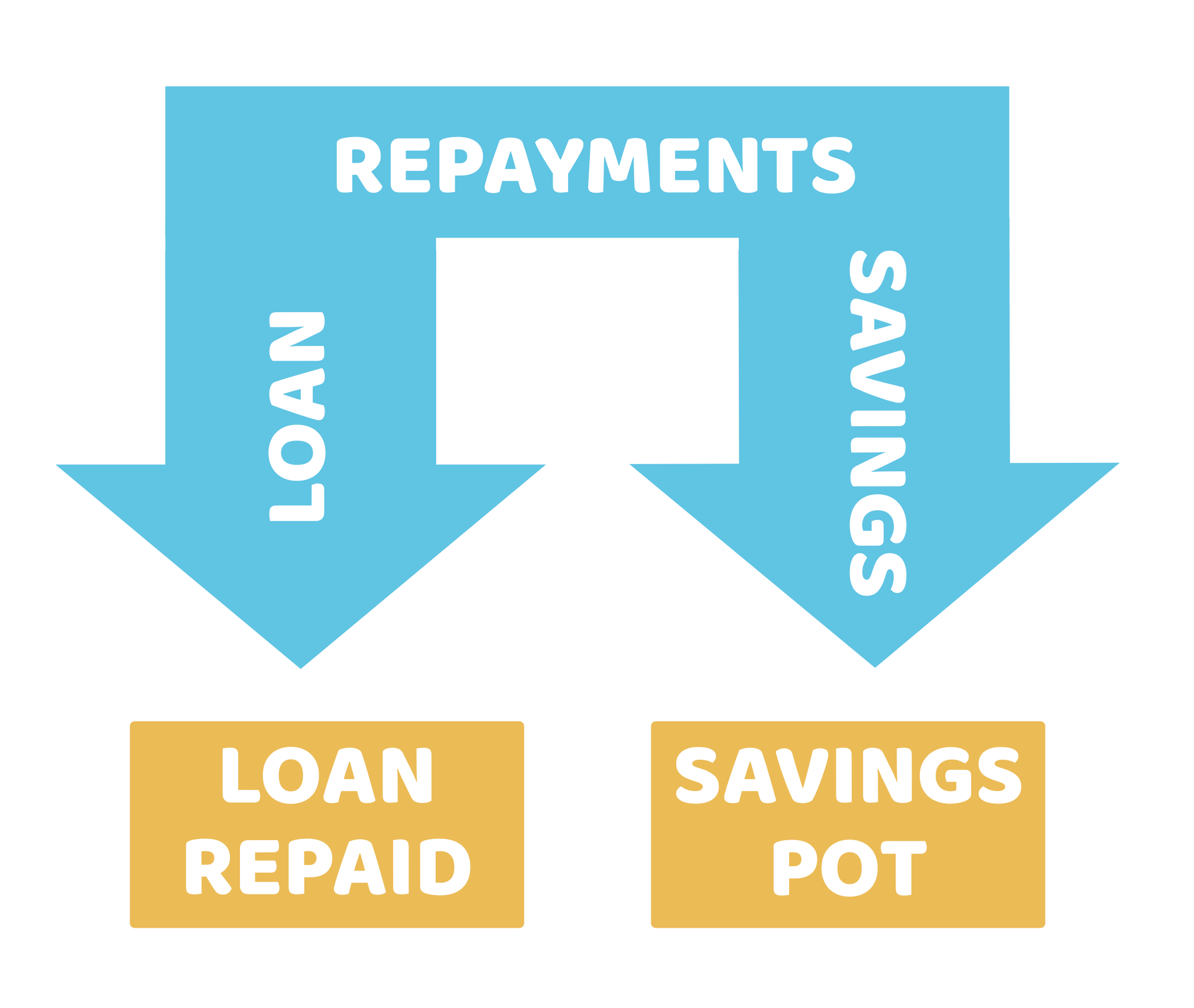

The simple idea

Each monthly payment includes a savings amount alongside the loan repayment. We tailor that split to your circumstances, so the payment stays affordable.

Example: Borrow £2,000 over 2 years. Pay £117.48 a month, made up of £100.82 toward the loan and £16.67 into your savings. At the end you’ve cleared the loan and built £400. That £400 is yours.

Why it helps

You repay what you need today, and you finish with a savings pot for tomorrow. Many members who’ve struggled to save find this makes the saving habit stick.

Your savings, your choice

The savings pot belongs to you. When the loan ends, you can withdraw it, keep saving, or put it toward your next goal.

By design

The savings element isn’t optional but we’ve yet to have anyone say they don’t want a savings pot that builds quietly in the background! We’re here to help you borrow at fair rates and help people build lasting savings habits at the same time.